Markets did not

go far since yesterday’s US close, as speculators are sitting on their hands

ahead of the US NFP report today at 12:30GMT. Expectations are 178K; if news

will be better than this, let’s say around 200K, then be aware of a strong push

higher on USD Index that will cause weaker majors. At the same time US bonds

could extend the decline based on QE tapering because of good data. Markets

however may not be ready for tapering just yet, there is a lot of risk involved

especially in stocks, and as a result we could see a spike higher on US stocks

futures on good number but then sharp bearish reversal on speculation for

tapering.

On the

other-hand, if data will be bad then stocks may not go far but EUR, GBP and

others will find a bid, but only temporary, because our wave patterns are

pointing for strong USD. Lets take a look at EURUSD and USDCAD

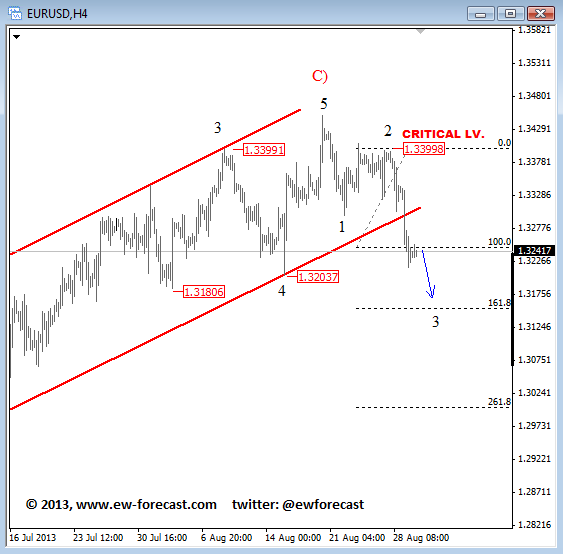

On EURUSD prices

fell sharply yesterday from 1.3220 which could be start of a larger impulsive

weakness. The reason is also a current bounce from 1.310 that has qualities of

a corrective move. As such, bias remains bearish. Intra-day resistance is seen

at 1.3150, at 38.2% Fibo level. Any rise back to 1.3220 will put pair in

bullish mode, but only temporary for a larger corrective rally.

EURUSD

30min

On USDCAD we can

see lower prices, but based on the wave structure since end of August we

suspect that pair is in final stages of a corrective move, called a flat

correction. Wave (c) already has five waves down, so be aware of a bounce.

Break above 1.0515 wave (iv) point will suggest that flat is complete and

bullish moves underway.

USDCAD

1h

.jpg)